Student loan forgiveness

24 Biden announced that tens of millions of Americans would be eligible for student loan forgiveness. The cutoff for married couples.

Student Loan Forgiveness Is Complicated Because This Is America The New York Times

A Texas-based federal court ruled on Thursday that Bidens sweeping student loan forgiveness plan is illegal.

. The federal student loan forgiveness program announced in late August was designed to move forward this year to enable many borrowers to see smaller monthly. In order to receive forgiveness most federal student loan borrowers whose income qualifies will need to submit an application form detailing their income. Heres what you should do.

First off youll want to know that you can get up to 10000 in federal student loan forgiveness if your income is 125000 or less or 250000 or less per couple. So if you earned 120000 in 2020 but got a big raise in 2021 you still qualify. Federal Student Aid.

Student loan forgiveness is when the balance on your college debt is set to zero regardless of how much you have left. Up to 20000 if they received a Pell Grant which is a type of aid. What is Student Loan Forgiveness.

However the loan forgiveness element does not apply to private student loan borrowers who account for an estimated 8 of total outstanding student loan debt in the US. People with existing federal student loans who earn less than 125000 a year are eligible for forgiveness. Fulfilling a campaign pledge President Joe Biden announced in August plans to forgive up to 20000 in federal student loan debt for individuals with incomes below 125000.

Earlier this week President Joe Biden announced a plan to cancel 10000 in student loan debt for borrowers whose annual income is less than 125000 or under. T he Education Department has stopped accepting new applications for student-debt forgiveness after a federal judge in Texas blocked the plan. To qualify for this forgiveness program you must have federal student loans and meet specific income requirements.

Borrowers can qualify for debt forgiveness based on their income in either the 2020 or 2021 tax year. The one-time debt relief plan makes borrowers earning less than 125000 annually or 250000 for couples eligible for up to 20000 in student loan forgiveness. President Joe Biden announced in August that most federal student loan borrowers will be eligible for some forgiveness.

November 11 2022 432 PM EST. Bidens one-time debt cancellation initiative would have provided. The income limits are based on your adjusted gross.

Student loan borrowers are now waiting indefinitely to see if theyll receive debt relief under President Joe Bidens student loan forgiveness program after a federal judge in. Up to 10000 if they didnt receive a Pell Grant which is a. Student loan forgiveness income limits.

The Department of Education estimates that this. The Biden Administrations plan to provide up to 20000 in loan relief for student borrowers is now halted after a federal judge in Texas blocked the. Forgive loan balances after 10 years of payments instead of 20 years for borrowers with original loan balances of 12000 or less.

Student Loan Forgiveness 5 Major Takeaways From New Plan To Cancel Student Debt

Is Student Loan Forgiveness Happening Feds Change Rules For Another Debt Relief Program

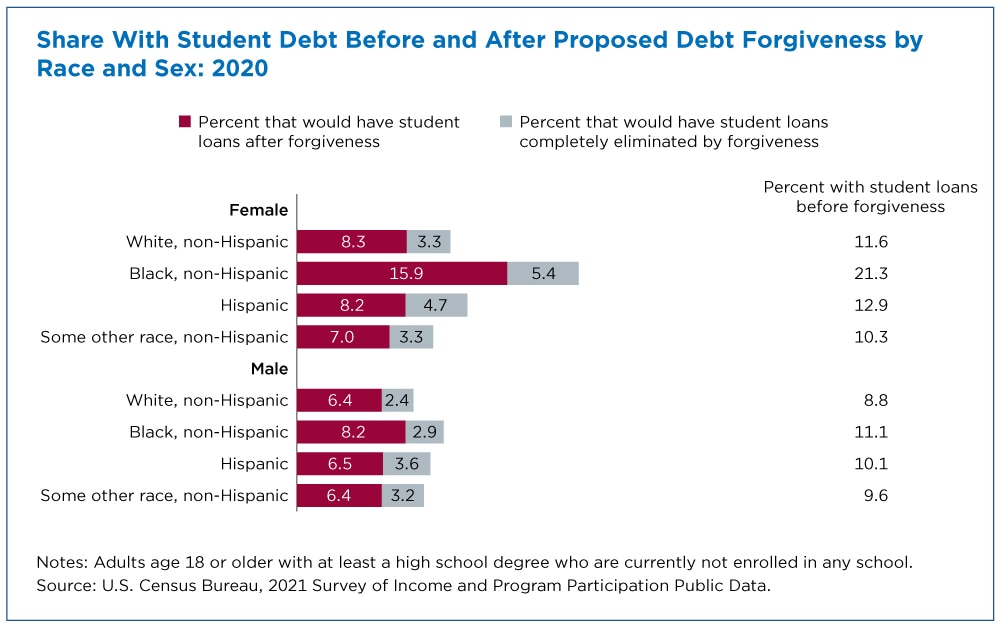

Who Is Impacted By Student Loan Forgiveness And How

Student Loan Forgiveness Applications Now Available Through Federal Student Aid Beta Launch

4 Charts That Show What Biden S Student Loan Forgiveness Means For America The Sun Times News

Who Are The Federal Student Loan Borrowers And Who Benefits From Forgiveness Liberty Street Economics

Student Loan Forgiveness Zoom Workshops Ohio Education Association

Here S What Our Readers Think About Biden S Student Loan Forgiveness Program Knbn Newscenter1

Joe Biden Could Have Gone A Lot Further On Student Loans Mr Online

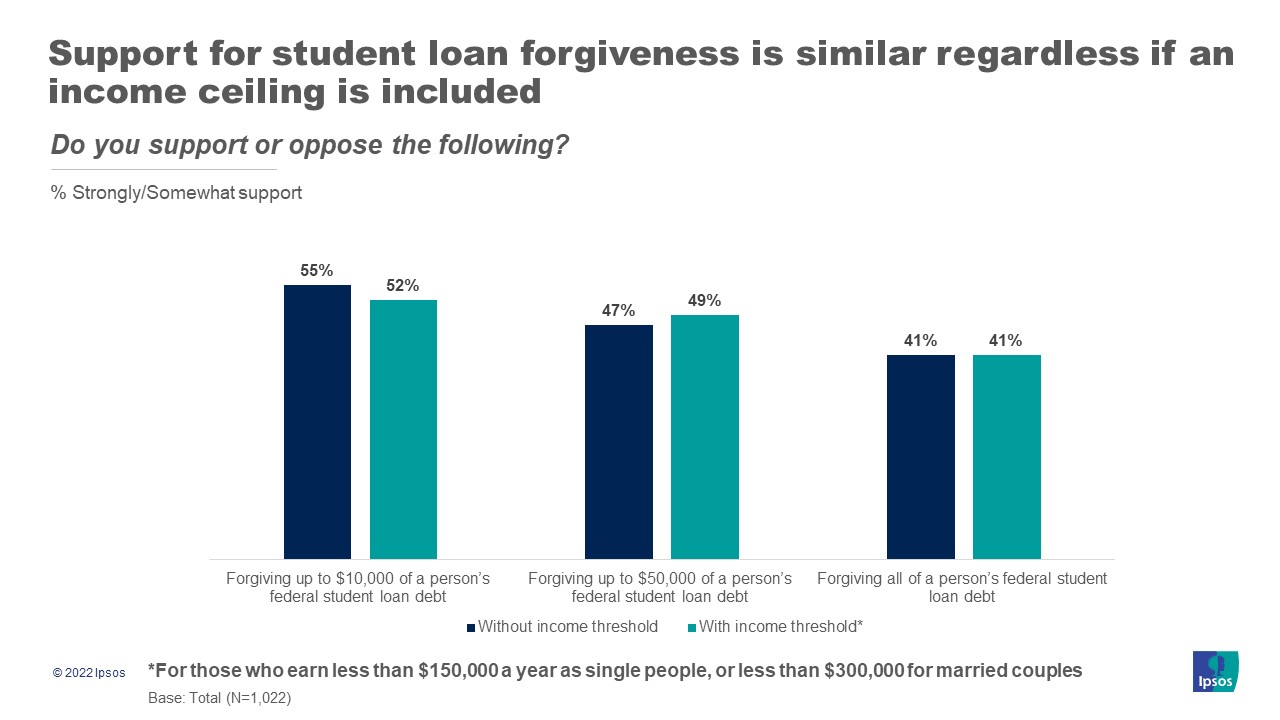

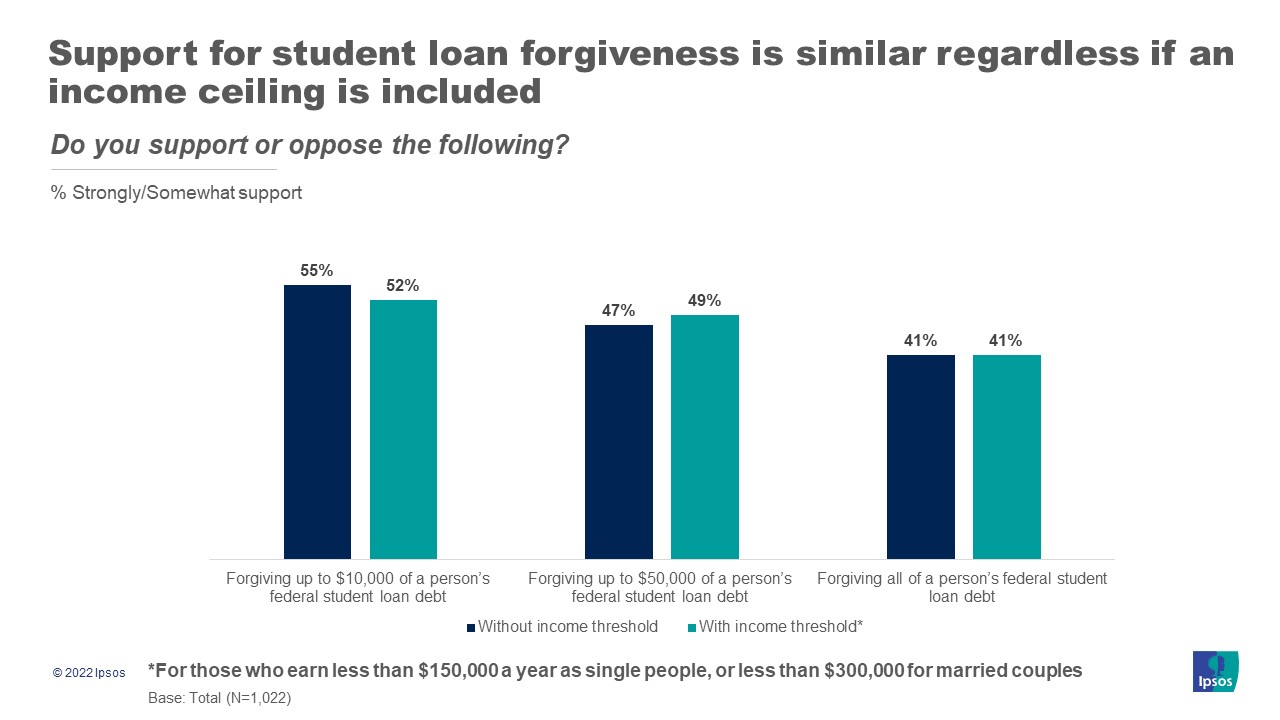

Support For Student Loan Forgiveness Varies Widely Between The American Public And Those With Loans Ipsos

Where Biden S Student Loan Forgiveness Plan Stands Cnn Politics

How To Apply Student Loan Forgiveness Opens In Early October Wset

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)